How Can I Start A Business as a Foreign Entrepreneur?

Establishing a business in the United States is a common objective for international entrepreneurs. Whether expanding an existing enterprise, launching a new venture, or entering the U.S. market, non-residents are legally authorized to form business entities under U.S. law, subject to compliance with applicable federal and state requirements.. At Bassey Immigration Law Center, P.A., we assist foreign entrepreneurs in complying with the legal and immigration requirements necessary to pursue their business goals in the U.S.

Here is what you need to know to begin.

Selecting the Appropriate U.S. Business Entity as a Foreign National

Choosing the correct legal structure for your U.S. business has significant implications for taxation, liability exposure, regulatory compliance, and long-term growth strategy.

Foreign entrepreneurs typically consider two primary entity types:

- Limited Liability Company (LLC): An LLC provides personal liability protection for its members and allows for pass-through taxation, meaning business profits and losses are reported on the owner’s personal tax return. LLCs generally involve fewer corporate formalities and are relatively straightforward to manage.

- C-Corporation: A C-Corporation is a separate legal entity subject to corporate income tax. It can retain earnings and issue multiple classes of stock, making it an attractive option for companies seeking outside investment. However, dividends distributed to foreign shareholders are generally subject to U.S. withholding tax under the Internal Revenue Code and any applicable tax treaties.

Note: S-Corporations are not available to non-resident aliens, as U.S. law restricts ownership of shares to U.S. citizens and certain categories of U.S. residents.

It is advisable to consult legal and tax professionals to determine which structure best aligns with your business goals and immigration status.

Where Should You Incorporate?

Foreign entrepreneurs may form a business entity in any U.S. state, regardless of their country of residence or physical presence in the United States. Delaware is a widely favored jurisdiction due to its well-developed corporate laws. Wyoming and Nevada are also commonly selected for their minimal reporting obligations and business-friendly regulatory environments.

Understanding E-1 and E-2 Visas for Foreign Entrepreneurs

If you intend to relocate to the United States to actively manage your business, nonimmigrant visa categories are specifically designed for this purpose. Two commonly used options are the E1 and E2 Visas:

- E-1 Treaty Trader Visa: Available to nationals of countries that maintain a qualifying treaty of commerce and navigation with the United States. It is intended for individuals engaged in substantial trade in goods, services, or technology between the U.S. and the treaty country.

- E-2 Treaty Investor Visa: Available to nationals of treaty countries who make a substantial investment in a bona fide U.S. enterprise. The applicant must enter the U.S. to develop and direct the business.

Both visa types require the applicant to be a national of a treaty country, and the business must have the present or future capacity to generate more than enough income to support the investor and their family.

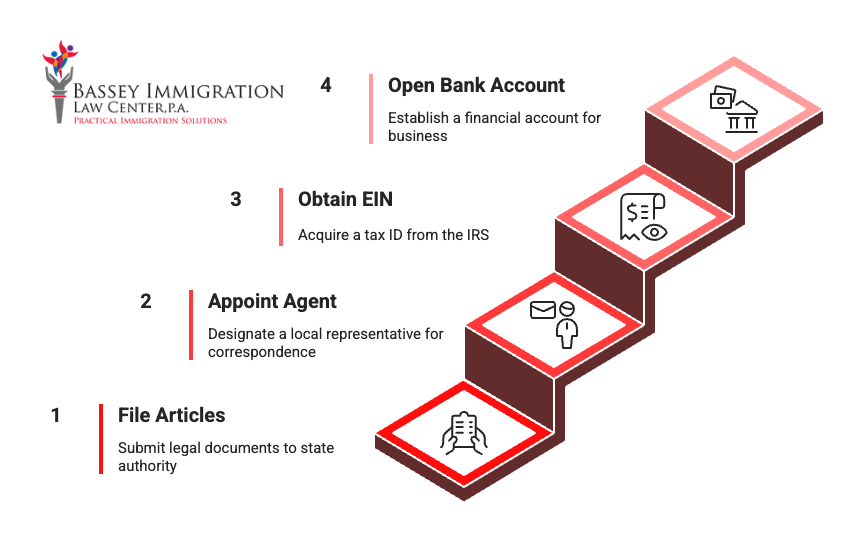

Key Steps to Legally Establish a U.S. Business

Once you have determined the appropriate legal entity type and jurisdiction of incorporation, the following steps are typically required to lawfully establish your U.S. business:

- File Articles of Organization or Incorporation with the appropriate state authority.

- Appoint a Registered Agent with a physical address in the state of formation to receive official legal and tax correspondence.

- Obtain an Employer Identification Number (EIN) from the Internal Revenue Service. An EIN is necessary to open a U.S. bank account, file taxes, and manage payroll obligations.

- Open a U.S. Business Bank Account, which may require your physical presence depending on the bank’s policies and your immigration status.

At Bassey Immigration Law Center, we guide foreign entrepreneurs through these steps to ensure that all documentation is accurate and compliant with applicable laws.

Contact Bassey Immigration Law Center, P.A. For a Consultation

Launching a U.S. business as a foreign entrepreneur involves multiple agencies, regulations, and filings. Working with experienced counsel can help you avoid delays and meet all legal requirements. If you would like to learn more about starting your U.S. company or explore visa options, contact our office to schedule an affordable consultation with an experienced business immigration lawyer today.

About Bassey Immigration Law Center, P.A.

Bassey Immigration Law Center, P.A., led by attorney Aniefiok Bassey, provides comprehensive immigration services to individuals, families, and businesses in Florida and beyond. With over 20 years of experience, the firm assists clients with a wide range of immigration matters, from family reunification and green cards to business visas and deportation defense. The diverse, multilingual team is dedicated to supporting clients through the complex immigration process, with a special focus on citizenship, asylum, and LGBTQ+ immigration needs. They offer affordable initial consultations and are committed to delivering personalized, strategic guidance for achieving clients’ immigration goals.